what is tax assessment in real estate

The tax rate is 070 per 100 of assessed value. Taxes apply to land and permanently attached structures like a home or building.

New York City Property Tax Assessment A Deep Dive Into How It S Done And How To Appeal Marks Paneth

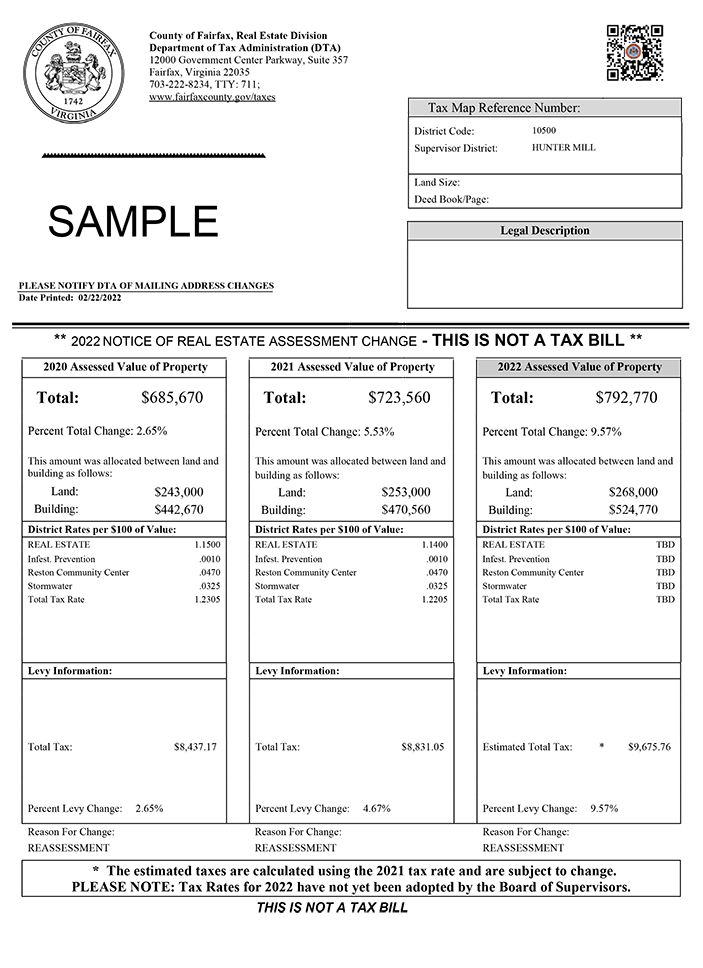

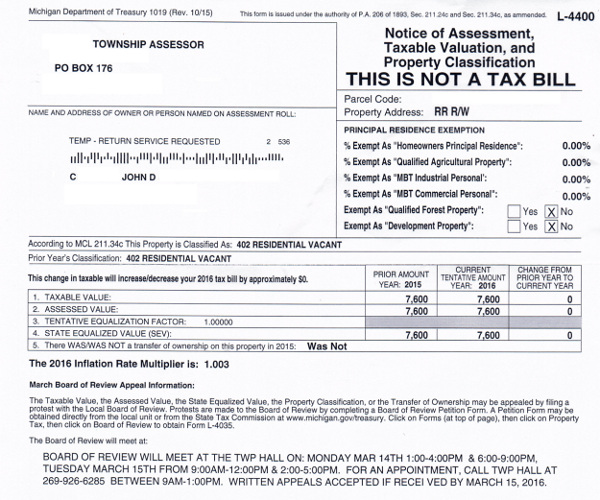

Your propertys assessment is one of the factors used by your local governments and school district to determine the amount of your property taxes.

. Understanding Real Estate Assessments. The Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the. The Horry County Assessors Office appraises and lists all real property for taxation and maintains ownership information.

It reviews legal residence or primary residence applications. All sales of real property in the state are subject to REET unless a specific exemption is claimed. A tax assessment determines the value of a piece of real estate.

Tax assessment is usually conducted by a government assessor who uses the assessed value of a property to. There are 24 local State assessment offices one in each county and Baltimore City. For the 2022 tax year the rates are.

Property taxes are the amount that is levied upon any real estate property which the homeowner has to pay annually to the government or Municipal Corporation of the area. Special assessments are charges levied to fund local improvements. 06317 City 07681 School.

In its most common form property tax is a special tax collected on real estate such as land and buildings. A recent study of property assessments for single-family homes in Detroit showed landlords tend to benefit from inconsistent assessments more than homeowners while they. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City.

Scott County Va Real Estate Taxes. Real estate excise tax REET is a tax on the sale of real property. Tips on Rental Real Estate Income Deductions and Recordkeeping Questions and answers pertaining to rental real estate tax issues.

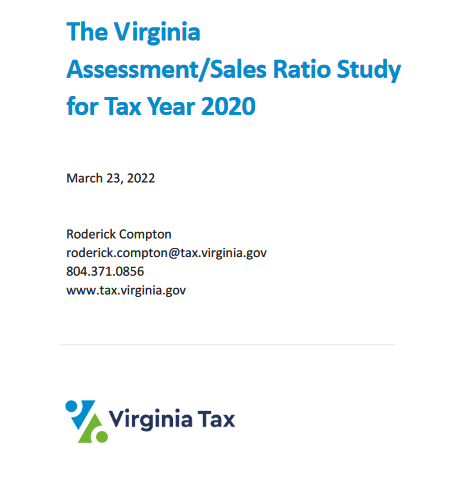

Mails and collects all Real Estate Taxes Personal Property and Boat Excise bills created by the Assessors Office and committed to the Collector through a warrant. Usually it is a percentage like 15 or 2 of the market value of the home minus homestead. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

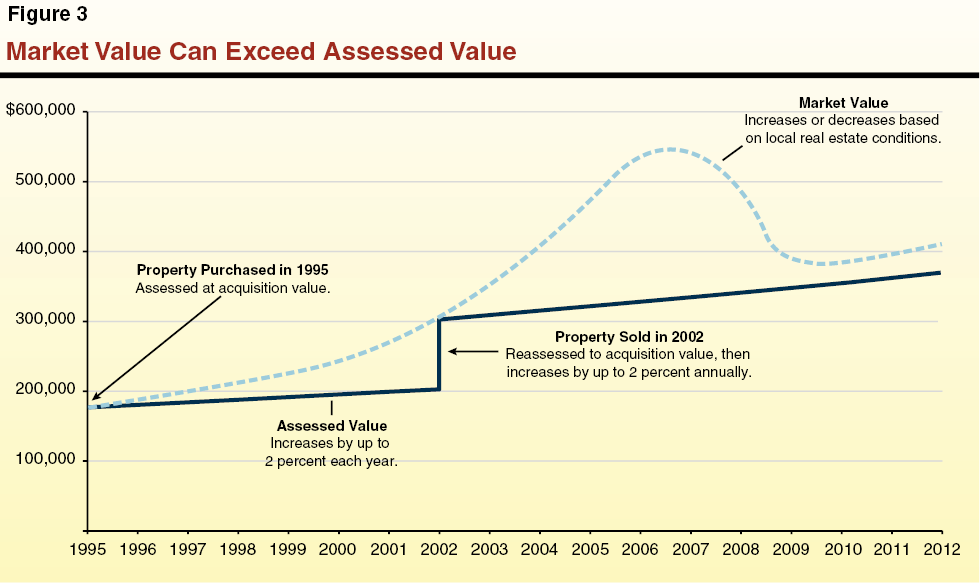

Assessments are certified by the Department to local governments where they are converted into property. The surtax is levied on owners and helps to pay for specific local infrastructure projects ie. In the United States property taxes are dependant on the fair market value of the.

Reporting and Paying Tax on US. While real estate taxes cover only taxes on real property like a condo home or rental property personal property taxes include tangible and movable personal property. Tax rates differ depending on where you.

Tax Collector Duties Include. The Scott County Board of Commissioners sets the real estate tax rate for the county. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable.

The tax assessor determines the millage rate in which the taxes are assessed.

Tax Assessment Archives Massachusetts Real Estate Merrimack Valley

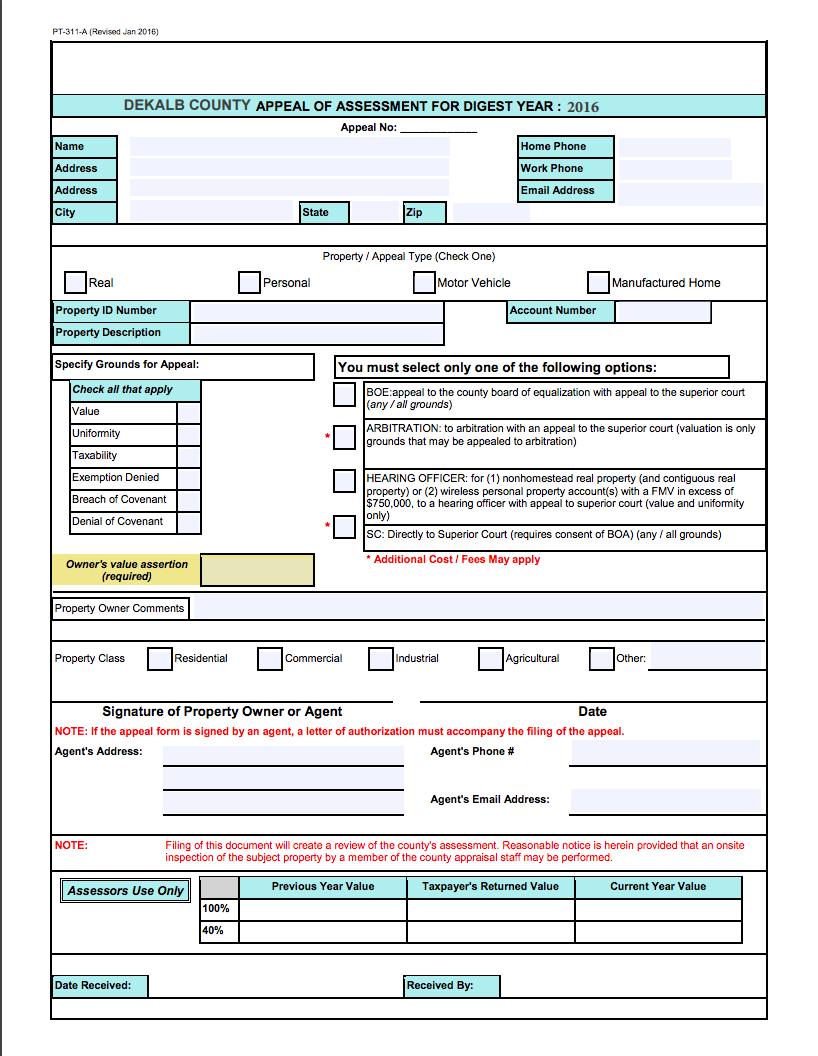

Property Tax Assessment Appeals Ernst Legal

Real Estate 101 Knowing Your Property Value And Challenging Your Tax Assessment Cohen Seglias

Grand Rapids Property Assessments Reflect Hot Real Estate Market Wwmt

Details On Real Estate Assessments And The Property Tax Bacon S Rebellion

114 Property Tax Assessment Illustrations Clip Art Istock

Appeal Property Tax Assessment In Vt Msk Attorneys

Understanding California S Property Taxes

Countywide Property Assessment Yeadon Borough

Understanding Your Real Estate Assessment Notice Youtube

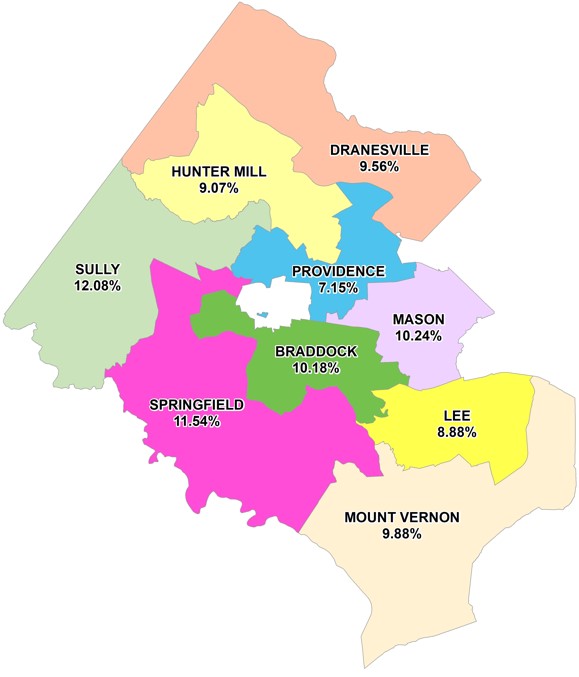

2022 Real Estate Assessments Now Available Average Residential Increase Of 9 57 News Center

Your Property Tax Assessment What Does It Mean

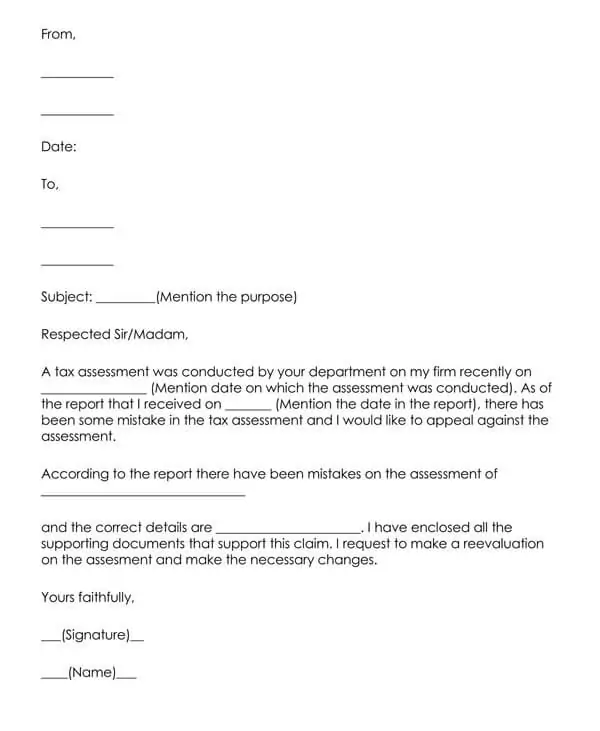

How To Appeal Your Property Tax Assessment Bankrate

How To Win A Property Tax Appeal Action Economics

Understanding California S Property Taxes

Real Estate Assessments Comparisons For Residential Properties Tax Administration

New York City Property Tax Assessment A Deep Dive Into How It S Done And How To Appeal Marks Paneth