property tax forgiveness pa

Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. What do I include in the Pennsylvania Tax Forgiveness Credit Schedule SP.

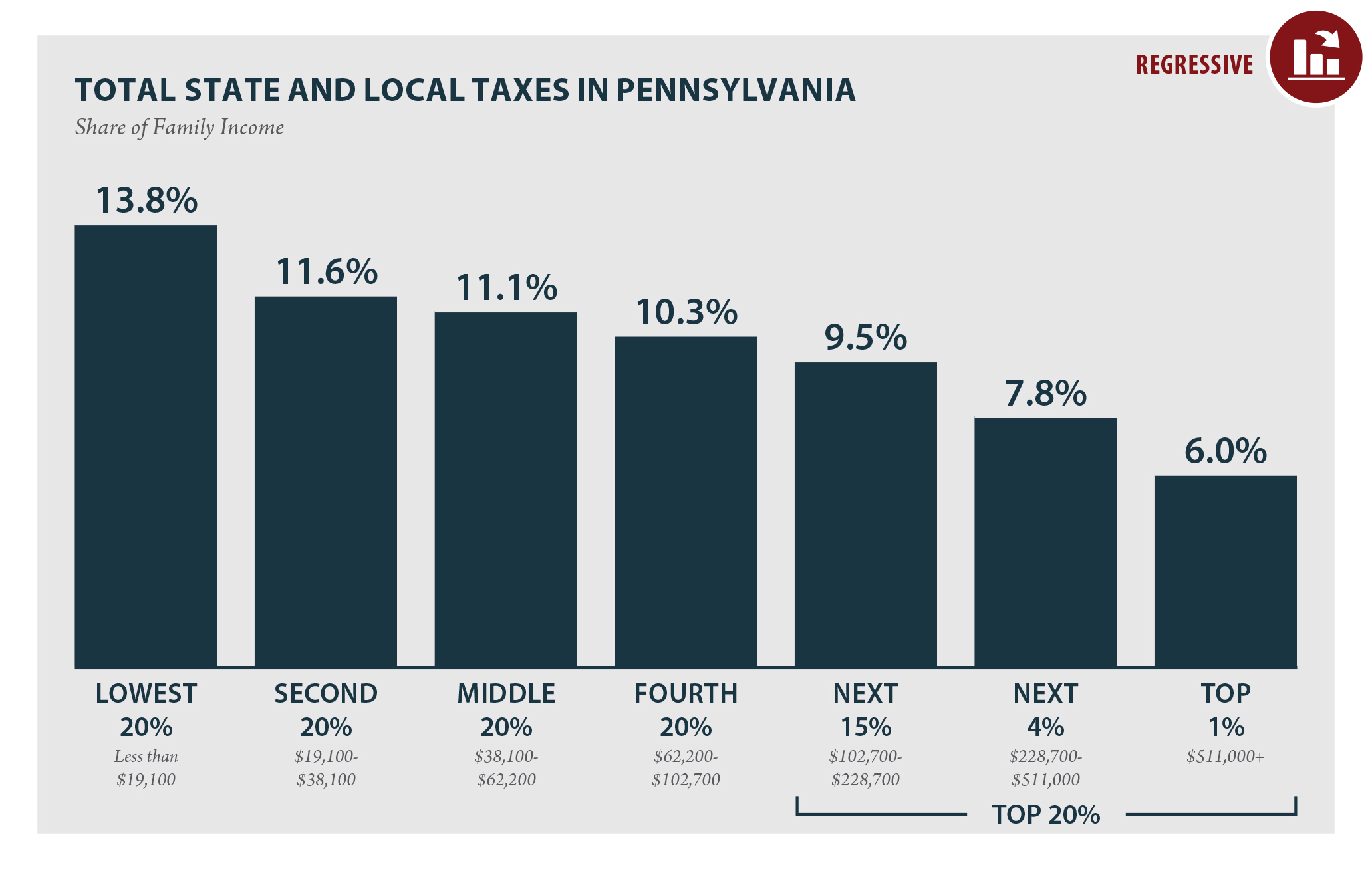

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Ra-retxpagov Please do not send completed applications or personally identifiable.

. Mortgage Relief Program is Giving 3708 Back to Homeowners. B On the second anniversary of the granting of real property tax relief under the PA. VIII 2c at 2-year intervals.

The information may be provided to federal state and local agencies including your local taxing authorities in connection with review of your application. All Allegheny County home owners who are 60 years of age or older who have resided in and owned their own home for at least ten years and have a total gross household income that is no greater than 30000 can qualify for the Senior Citizen Property Tax Relief Program Act 77. Pay your bill on or before the discount date in April - receive a 2 discount.

Property tax reduction will be through a homestead or farmstead exclusion. These standards vary from state to state. On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr.

Will be used to review and determine your eligibility for exemption for real property taxes under Article 8 Section 2c of the Pennsylvania Constitution and 51 PaCS. Help for unpaid and delinquent property taxes. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

Do you qualify for 30 discount on your county taxes. How do I know if I qualify for the Tax Forgiveness Credit on my Pennsylvania return. Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year.

Since the programs 1971 inception older and disabled adults have received more than 71 billion in property tax and rent relief. Check Your Eligibility Today. The instructions for filling out PA Schedule SP are included in PA-40 instructions available on the departments websitewwwrevenuepagovtaxforgiveness.

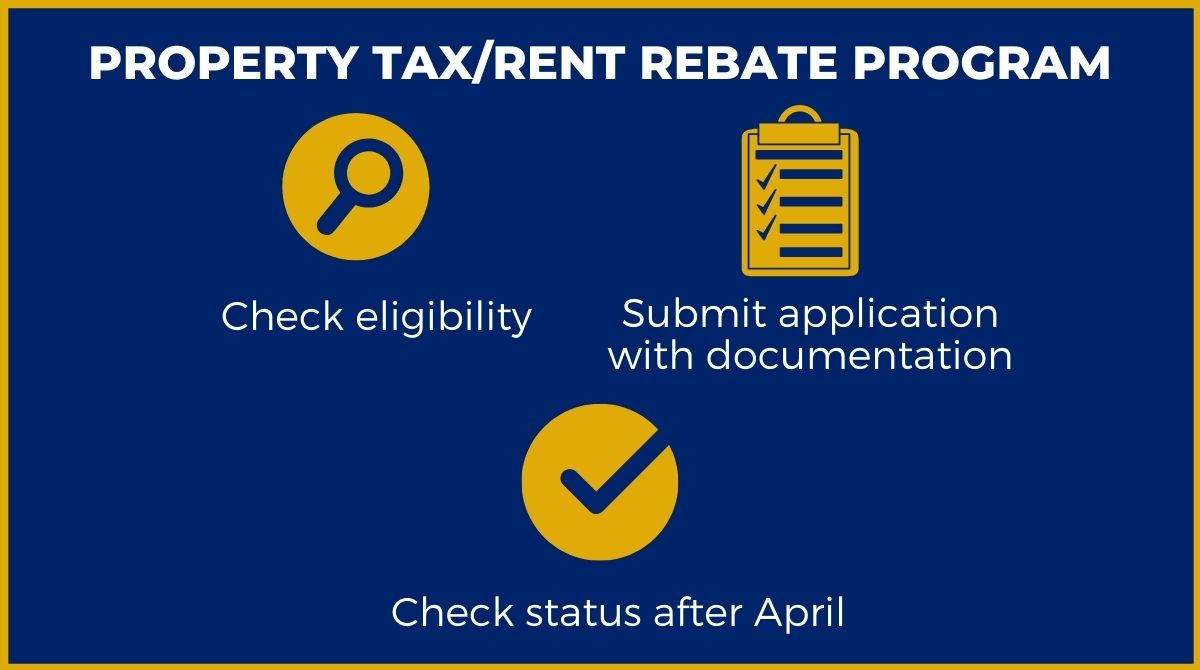

To apply for Tax Forgiveness submit a completed PA Schedule SP when you file your PA-40 personal income tax return. Property tax forgiveness pa. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

Provides a reduction in tax liability and. Application forms for the Property TaxRent Rebate Program are now available for eligible Pennsylvanians to begin claiming rebates on Read More Harrisburg PA. The rebate program also receives funding from slots gaming.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate implementation of the Real Property Tax Forgiveness Program the Program as outlined in The Real Property Tax Amnesty Order 2021 the Order and which came into effect on 1. To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP. State Tax Forgiveness.

To issue property tax and rent rebate checks early to assist seniors and individuals with disabilities Property Tax Relief in Pennsylvania The Pennsylvania Budget and Policy Center. This can be done in the form of tax credits or exemptions. Real property debts incurred and due for fiscal year 2012-2013 and previous tax periods as well as any debts related to the personal property tax returns through tax year 2012.

Code 524 relating to processing applications. It is not an automatic exemption or deduction. States also offer tax forgiveness based on personal income standards.

This can be done in the form of tax credits or exemptions. Many state and county governments allow homeowners the ability to enter into property tax installment plansSome of these programs have been recently created as a result of the housing crisis and the national recession. What is the Pennsylvania Property Tax or Rent Rebate Program Form PA-1000.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. City Real Estate Property Taxes are based on a calendar year from January 1 thru December 31 of the current year. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired.

The County Board for the Assessment and Revision of Taxes will grant the tax exemption. Further to qualify for the credit it is necessary to calculate both the. This section cited in 43 Pa.

Waiver of interest surcharges and penalties on outstanding real and personal property tax debts with the Municipal Revenue Collection Center CRIM. Which states do Pennsylvania have. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability.

Forgives some taxpayers of their liabilities even if they have not. 135 of home value. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal.

Property Tax Relief In Pennsylvania The Pennsylvania Budget. FREE Form PA PA. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

For example in Pennsylvania a single person who makes less than 6500 per year may qualify to have 100 percent of their state back taxes forgiven. Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. How do I claim the Pennsylvania Credit for Taxes Paid to Another State.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. If you think you may have trouble meeting your tax obligations there are several programs in pa that can reduce the amount of property tax you owe or offer you a rebate on property tax paid. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

About The Taxpayer Relief Act. Pennsylvania is ranked number sixteen out of the fifty states in order of the. A The Commission will review cases that have been granted real property tax relief under the PA.

Property Tax Forgiveness Pa. Pay after the Face Amount due date in June - a 10 penalty is. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district.

Tax amount varies by county.

Pa Budget Battle Is Covid Relief Money The Cure For Property Tax Rates Gop Says No Dems Say Yes Pittsburgh Post Gazette

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

Analysis Says Millions Avoided In Pa Property Taxes Impact Of Relief Depends On Perspective Local News Ncnewsonline Com

Taxing Retirement Income Part Of New Pa School Property Tax Relief Plan

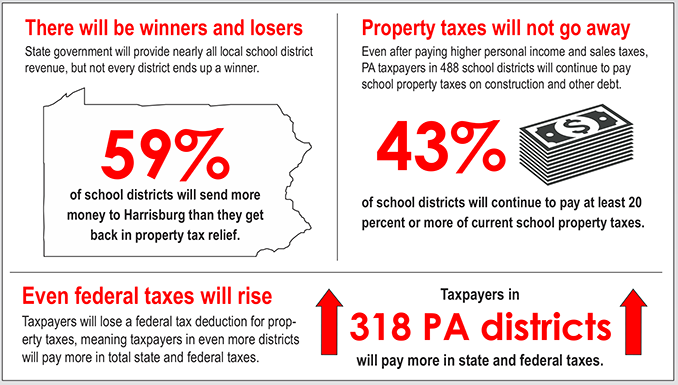

Property Tax Bill Will Cost Pa Taxpayers More

Infographic Property Tax Relief In Gov Wolf S Budget

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

Property Tax Relief Through Homestead Exclusion Pa Department Of Community Property Tax Homesteading Relief

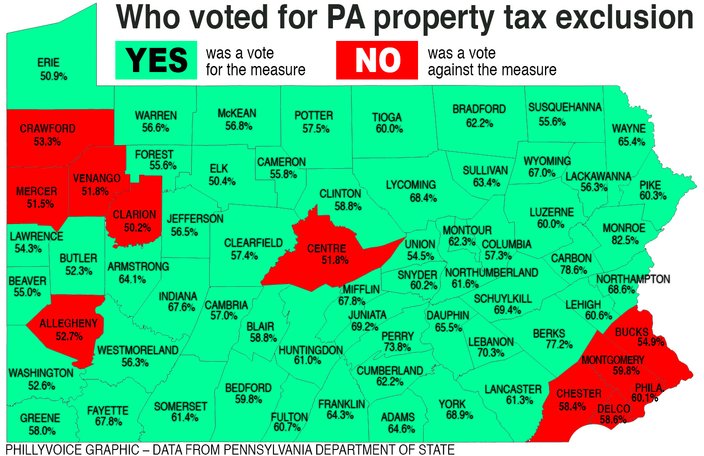

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

.png)